Sales Tax Malaysia 2018 in Cars

2018 Car Price in Malaysia without GST. With the exemption in place it means that the sales tax is fully waived for locally assembled car or charged at 5 for imported cars.

Malaysian Car Sales Expected Up With Gst Abolition Wardsauto

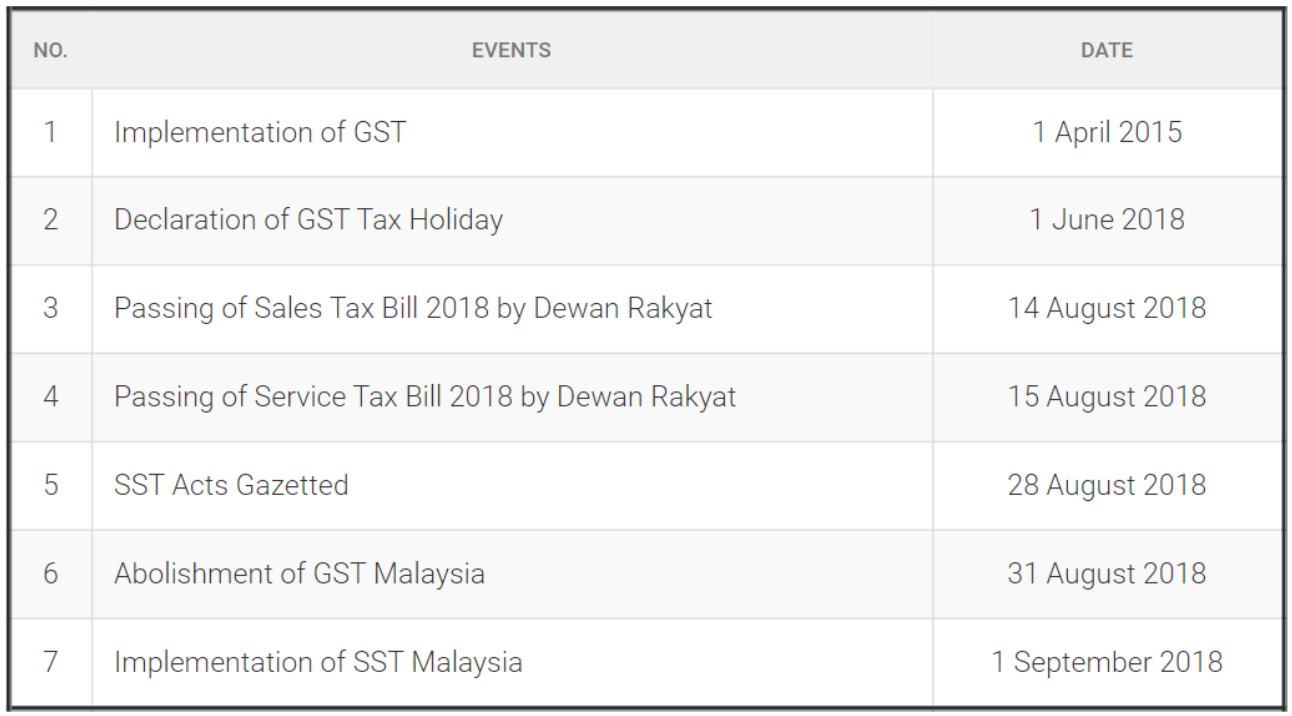

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018.

. The Sales Tax Amendment Bill 2022 is an amendment to the Sales Tax Act 2018 which doesnt only affect car parts. Sales tax is a single-stage tax charged and levied. Of the RM 11 billion in excise duty revenue it is estimated that sale of new cars contribute about RM 6 billion estimated based on a 2017 version of the same document when MoF puts contribution from excise duty of 2018 cars at RM 62 billion.

The Ministry of Finance issued the following updated Sales Tax Excise Duties and Customs Amendment Orders all with an effective date of 1 June 2022. Logo vector created by Freepik. Meaning of manufacture Part II ADMINISTRATION 4.

On taxable goods imported into Malaysia. Updated sales tax excise duties and customs orders. A GST perspective In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia.

Persons appointed or employed to be public servants 6. RATE OF TAX SALES TAX RATE OF TAX ORDER 2018 5 10 RM000lit 5 - reduced sales tax rate First Schedule in the Order 10 - default sales tax rate Specific rate for petroleum products Second Schedule in the Order RATE OF TAX 5 How to determine the rate of sales tax for goods. What is Sales and Service Tax.

The tax is also imposed on taxable goods imported into the Federation Sales tax. Motor vehicles transported and exported to a place outside Malaysia by a registered manufacturer are exempted from payment of sales tax base on item 56 Schedule A of the Sales Tax Person Exempted from Payment of Tax Order 2018 provided that the exportation is declared in the Customs Form No. What are the goods subject to sales tax.

LAWS OF MALAYSIA Act 806 SALES TAX ACT 2018 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1. Recognition of office 7. 4 of the total value of taxable goods purchased if the taxable goods were charged and levied with sales tax of 10 Payment of sales tax and taxable period Sales tax is due at the time the taxable goods are sold disposed of otherwise than by sale or first used otherwise than as materials in the manufacture of taxable goods by the taxable person.

Any foreign goods bought online and shipped. A single-stage tax imposed on products manufactured and produced locally and on taxable goods imported into Malaysia. The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so.

Functions and powers of Director General and other officers 5. The automotive industry has lauded the governments move to fully exempt sales tax for locally assembled cars and halved the sales tax for imported cars to 5 from 10 from June 15 to Dec 31 2020. A consumption tax imposed on taxable services provided in Malaysia.

What is sales tax. According to data from the Malaysian Automotive. Initially parts retailing at below RM 500 are not subjected to any tax when imported into Malaysia.

On the 5th of June 2020 the government announced that sales tax would be waived for all new CKD cars until the end of the year. Sales tax administered in our country is a single-stage tax charged and levied on locally manufactured taxable goods at the manufacturers level and as such is often referred to as manufacturers tax. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Short title and commencement 2. The move was lauded by automotive players and consumers. Digging through historical figures a Perodua Myvi 15 Advance AT was priced at RM54090 inclusive of SST in 2018 but was RM5218623 during the tax holiday without GST or SST in effect an.

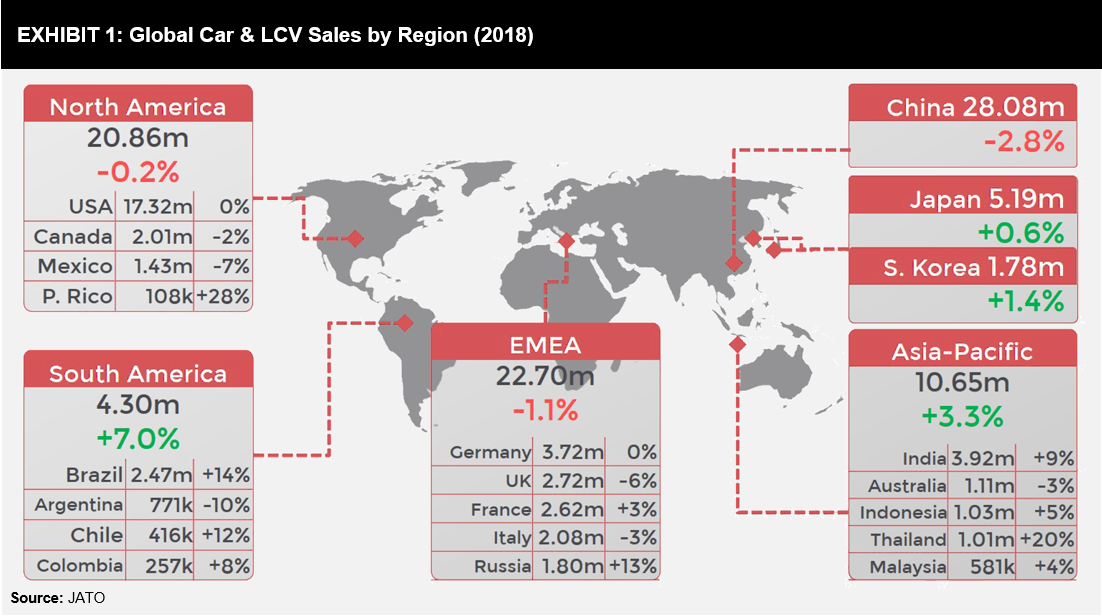

On 31 August 2018 GST was abolished and SST was implemented on 1 September 2018. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax. With the start of a new year comes the end of an old one and the automotive industry rounded off 2018 with a whimper than a bang sales wise.

50 sales tax exemption for the purchase of imported cars also referred to as completely built-up CBU cars Currently the sales tax for vehicles is set at 10 for both locally assembled and imported cars. Although not as significant as CKD cars CBU cars will also enjoy a tax break incentive and see their sales tax cut down to 5 percent. FREQUENTLY ASKED QUESTIONS FAQ - Sales Tax 2018 SALES TAX 1.

Reducing the cost of doing business. List updated 1 June 2018. The SST comprises of two elements.

Buying a Car Costs News Savings. The Sales Tax Act 1972 came into force on 29 February 1972. This is about to change once the King Yang di-Pertuan Agong gives his Royal Assent.

On taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed off. In the Short-term Economic Recovery Plan announced by Prime Minister Tan Sri Muhyiddin Yassin yesterday locally assembled cars will be fully exempted from the sales tax while for imported cars the sales tax will be cut from 10 to 5 from June 15 to Dec 312020.

Malaysia S Richest 2018 Anthony Tan S Grab Hits 6b Valuation As The Ride Hailing Race Quickens

Used Toyota Avanza 2018 For Sale Rm12 000 In Bangi Selangor Malaysia Toyota Avanza 1 5e 2018 Monthly Rm1050 Balance 6 Years Used Toyota Toyota Car Comfort

Cars For Sale In Ireland Cars For Sale Citroen C1 Ireland

Why There Is Hope For The Auto Industry Futurebridge

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysia Sst Sales And Service Tax A Complete Guide

0 Response to "Sales Tax Malaysia 2018 in Cars"

Post a Comment